when are property taxes due in illinois 2019

In the calendar year 2019 we will be paying real estate taxes for the 2018 year. Assessment is based on a unit called a mill equal to one-thousandth of a dollar.

States With Highest And Lowest Sales Tax Rates

Early Pre-Pay Tax Payments.

. Posted on 12172019 By. The State of Illinois does not have a statewide property tax. Two or More Story Residence Over 62 Years up to 2200 Sq.

Once the exemption is applied the Assessors Office auto-renews it for you each year. Tax Sales 2022 Scavenger Sale. 2021 2024 2027 all City of Chicago townships North Tri.

The median annual property tax paid by homeowners in Sumner County is 1399. Buyers are credited by sellers with an amount to cover the previous years taxes. To avoid late penalty charges your tax bill must be paid before each due date.

The typical homeowner in the Gem State pays 1616 annually in property taxes almost 1000 less than the national average. COOK COUNTY TREASURERS OFFICE. One reason for the states relatively low property taxes is the homeowners exemption.

Therefore taxes are based on the 2019 valuation until then. Real estate taxes are billed and collected a year behind. That includes both the land itself and the structures on it.

If you would like to pre-pay your taxes please send payment with your parcel numbers and we will credit your taxes when the bills are sent. This exempts half the value of owner-occupied primary residences from property taxes up to a limit of 100000. When you start paying property taxes on a new home is largely the same whether you move into a previously owned home or a new construction home.

Some states have notoriously high property tax rates New Jersey Illinois and New Hampshire are all up there while. 69 95 State Additional Start for Free Pay only when you file. Monday February 14 through Tuesday March 2 2022 2019 Annual Sale.

A Homeowner Exemption provides property tax savings by reducing the equalized assessed. So vacant land will likely have lower real estate taxes due to a lower assessed value. So we took a closer look into property taxes by state to give you a comparative look.

Tax Year 2020 First Installment Due Date. Calculating property taxes. For example if you did not pay one or both property tax installments on your 2017 taxes due in 2018 you may not include the portion of the 2017 taxes that you did not pay when figuring your.

Denise Trame 618-594-6650 ASSESSMENTS. Benefits Forms Reviews Requirements 100K Accuracy Guarantee Our accuracy guarantee is more than our wordits backed by 100k. Search 34 million in missing exemptions going.

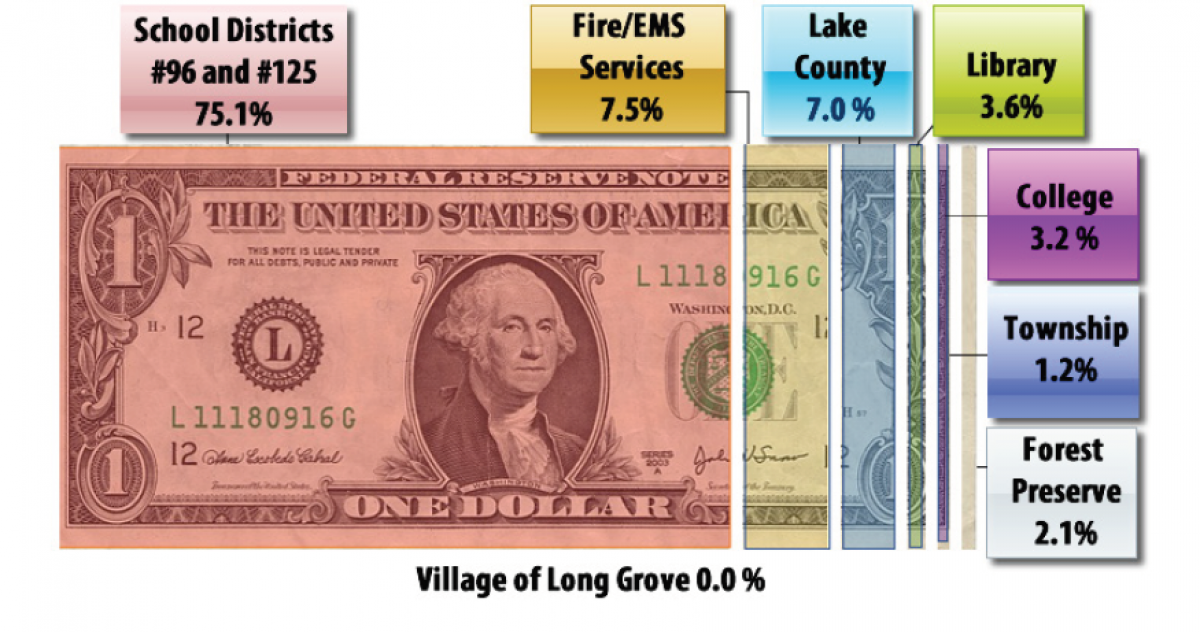

Property taxes are determined at local levels and pay for services such as schools libraries park districts fire protection districts and others. Cook Countys property tax assessment schedule through 2020 is broken into three sections. In that case a property in Hawaii with a property tax rate of 030 will look more attractive than a property in Illinois with a property tax rate of 222.

Information about Prior Year Property Taxes. With a difference of 192 this shows us that property taxes vary significantly from state to state. Most homeowners are eligible for this exemption if they own and occupy their property as their principal place of residence.

Paying First Installment Property Taxes Early. The countys most recent reappraisal took place in 2019 which means the next reappraisal will not be held until 2024. Property owners are responsible for ensuring their real estate taxes are paid even if they are new owners.

Any portion of the property tax due that you did not pay in the tax year. The current 2021 tax year exemption applications are now available. Even if you think your return is complex we make filing your taxes easy and will help find the tax advantages you deserve.

Sumner County is located northeast of Nashville along the state border with Kentucky. 2 days agoAfter reporters tried to ask the restaurants operators about that Potbellys sent the treasurer a check May 28 for 81146 to cover the unpaid. View taxing district debt attributed to your property.

Search 84 million in available property tax refunds. Cook County Stats. Across the United States the mean effective property tax ratetotal real estate taxes paid divided by total home valuewas 103 for 2019 according to data from the Tax Foundation a tax.

Tuesday March 2 2021. 2019 2022 2025 all Cook County townships north of North Avenue not in the City of Chicago. Scheduled to be held May 12 through May 18 2022.

Where S My Illinois State Tax Refund Il Tax Brackets Taxact

Illinois Pritzker Promised To Lower Property Taxes He S Only Made Them Worse Wirepoints Wirepoints

Illinois Taxes Illinois Economic Policy Institute Illinois Economic Policy Institute

Property Tax City Of Decatur Il

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

What S Being Done To Reduce High Property Taxes In Illinois Property Tax Estate Tax Illinois

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

Need Any More Proof Than This Find A Job New Opportunities Names

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

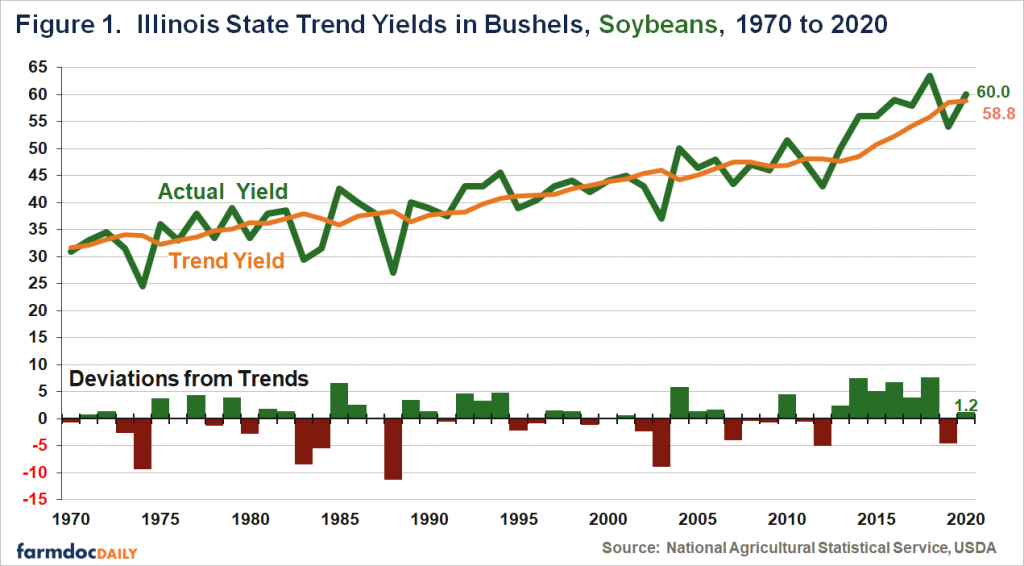

Recent State Soybean And Corn Yields In Illinois Farmdoc Daily

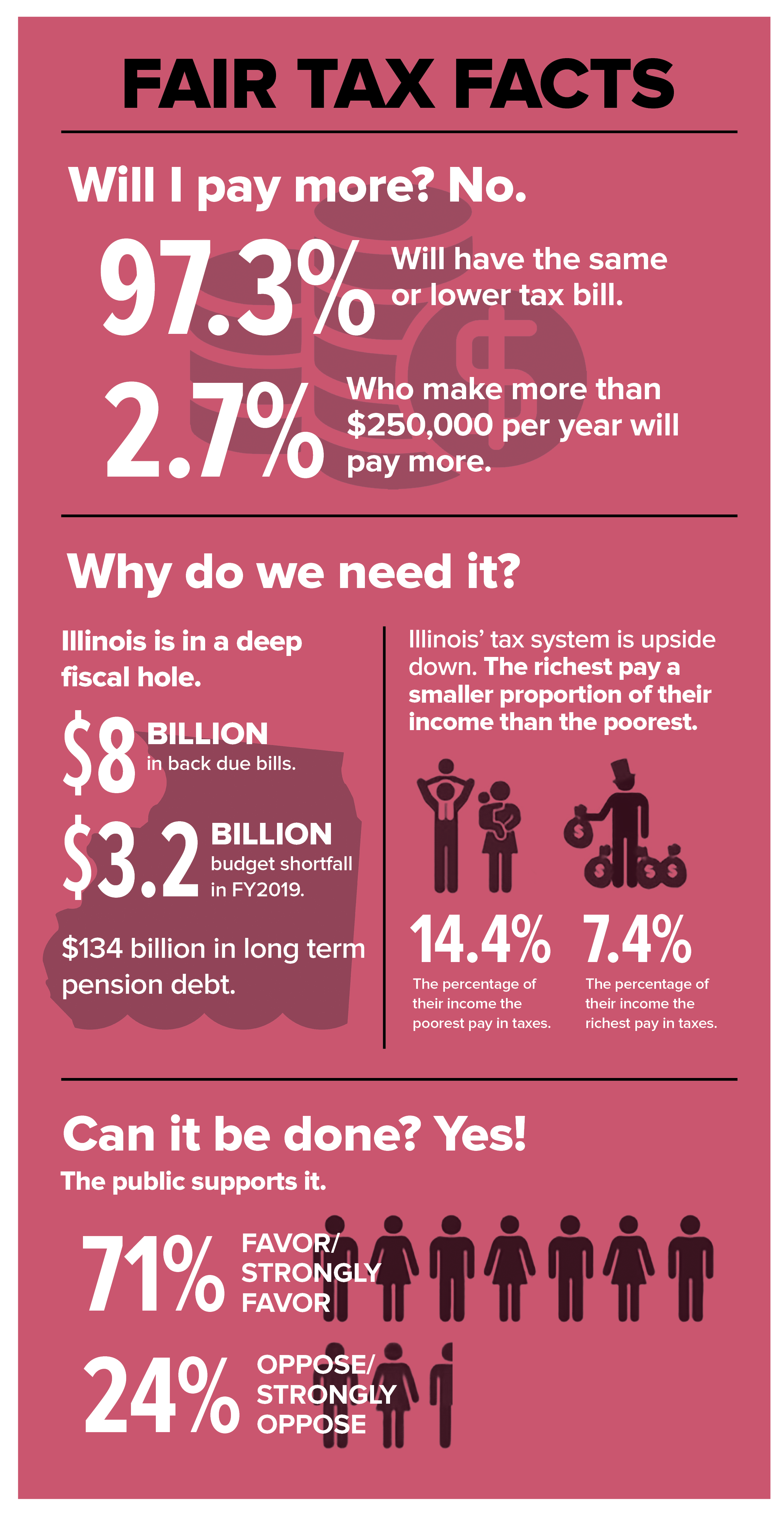

Illinois Needs Fair Tax Reform Afscme Council 31

Illinois Income Tax Rate And Brackets 2019

Taxes Fees Long Grove Illinois

Illinois Property Tax H R Block

2022 Break Even Prices For Corn And Soybeans Farmdoc Daily

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation